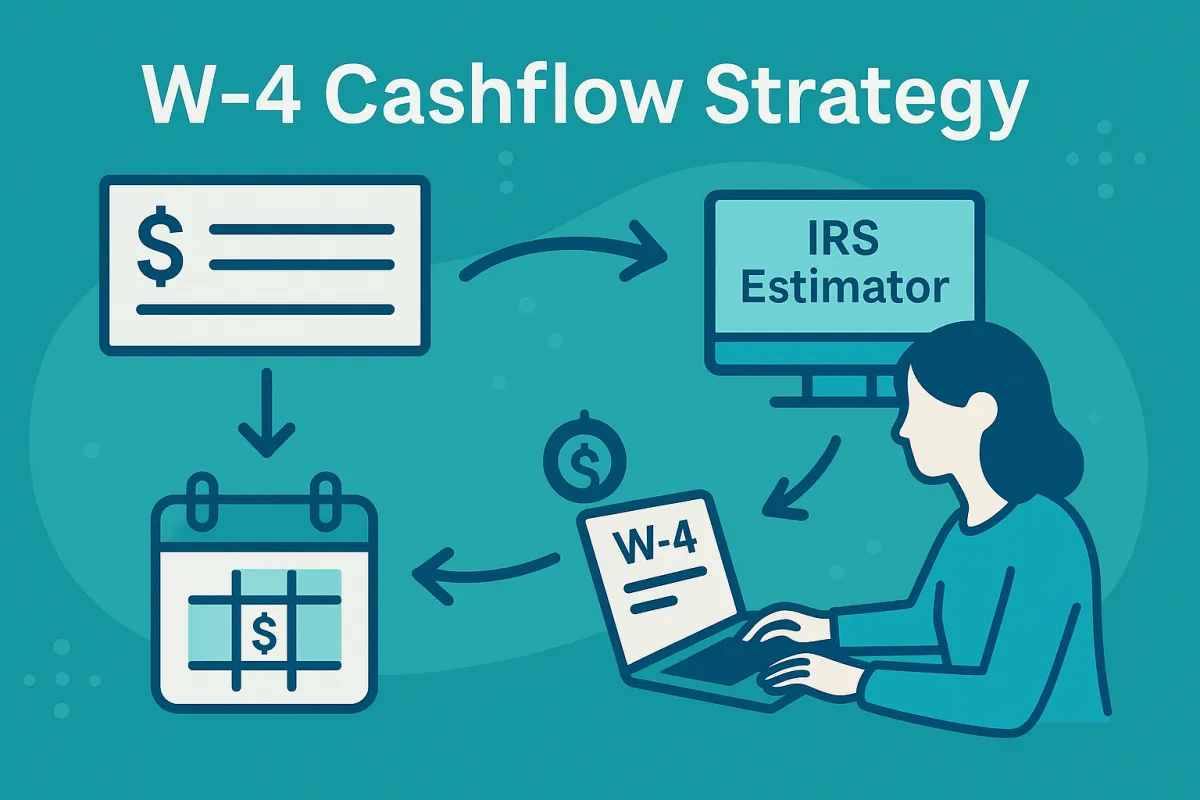

W-4 Cashflow Strategy

The W-4 Strategy: How Homeowners Can Unlock Extra Monthly Cashflow

If you’re like most homeowners, you probably look forward to that big tax refund every spring. But here’s the truth: a refund isn’t a bonus—it’s just the IRS giving you back the money you overpaid all year long. In other words, you’ve been giving the government an interest-free loan.

That’s where the W-4 strategy comes in. By adjusting your paycheck withholding, you can put that extra money back into your budget every month instead of waiting until April. For homeowners and homebuyers, this can make a huge difference in affordability and cashflow.

Why the W-4 Strategy Matters for Homeowners

When you own a home, you pay thousands each year in mortgage interest, property taxes, and mortgage insurance (MI). The good news? Many of these expenses are tax-deductible. But here’s the catch—most people never use those deductions to adjust their paycheck withholdings.

That means they wait a full year to see the benefit in the form of a tax refund. With the W-4 strategy, you can capture those benefits now and improve your monthly budget.

Step 1: Estimate Your Tax Benefits

Start by using our Tax Benefit Calculator. It gives you a clear estimate of:

How much mortgage interest you’ll pay this year

Your expected property taxes

Any mortgage insurance (MI) you’re paying

These are the numbers you’ll need to plug into the IRS’s system to fine-tune your paycheck withholding.

Step 2: Use the IRS Tax Withholding Estimator

Once you know your tax benefits, head over to the official IRS tool:

👉 IRS Tax Withholding Estimator

Enter the amounts from our calculator into the Estimator. This will give you a personalized withholding recommendation based on your income, deductions, and filing status.

Step 3: Update Your W-4

After you have the IRS results, it’s time to make it official. Submit an updated Form W-4 to your employer’s payroll or HR department. That’s all it takes to shift from a big refund once a year to more money in your pocket every month.

How This Helps When Buying a Home

For buyers, every extra dollar of monthly income matters because lenders look at your debt-to-income (DTI) ratio. By increasing your take-home pay through the W-4 strategy, you may:

Qualify for a larger mortgage

Free up cash for closing costs or moving expenses

Smooth out your monthly budget so homeownership feels more affordable

A Quick Reminder

⚠️ The W-4 strategy doesn’t change how much tax you owe. It just changes when you get access to your money—throughout the year instead of as a refund.

Branch: Canopy Mortgage - TLC Group - 13809 Research Blvd, Ste 500, Austin, TX 78750 | Office #512-598-9093 | NMLSConsumerAccess.org #: 1359687 | Equal Housing Lender -All loans subject to credit and property approval.

Consumers wishing to file a complaint against a banker or a residential mortgage loan originator should complete and send a complaint form to the Texas department of savings and mortgage lending, 2601 North Lamar, suite 201, Austin, Texas 78705. Complaint forms and instructions may be obtained from the department’s website at www.sml.texas.gov. A toll-free consumer hotline is available at 1-877-276-5550. The department maintains a recovery fund to make payments of certain actual out of pocket damages sustained by borrowers caused by acts of licensed residential mortgage loan originators. A written application for reimbursement from the recovery fund must be filed with and investigated by the department prior to the payment of a claim. For more information about the recovery fund, please consult the department’s website at www.sml.texas.gov. State Licenses page, Privacy Policy, and Terms of Use

Facebook

Instagram

LinkedIn

Youtube

TikTok