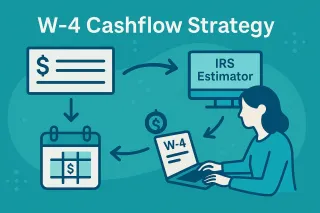

W-4 Cashflow Strategy

Learn how to use our Tax Benefit Calculator and the official IRS estimator to shift tax savings from a year-end refund into your monthly budget—making homeownership more affordable and less stressful. ...more

Buying Your First Home

September 12, 2025•2 min read

1st-Time Buyer Tax Benefit

For first-time buyers in 2025, the combination of mortgage-interest + SALT deductions, energy credits, a possible MCC, and the IRA penalty exception can materially improve affordability—especially in ... ...more

Buying Your First Home

September 08, 2025•4 min read

15% MCC Tax Credit

Maximize affordability with a 15% uncapped MCC tax credit for 10 years. Understand eligibility, effective interest cost, and steps to claim your savings. ...more

Buying Your First Home

September 08, 2025•4 min read

Is February 2024 the Perfect Time to Buy Your First House?

In the ever-fluctuating landscape of the real estate market, making the decision to purchase your first home requires careful consideration. As of February 2024, prospective buyers may find themselves... ...more

Buying Your First Home

February 15, 2024•4 min read

What Is An (APR) Annual Percentage Rate

Annual Percentage Rate (APR) is a calculation that represents the projected annual cost of borrowing for a mortgage to its full term, expressed as a percentage. ...more

Buying Your First Home

October 27, 2023•2 min read

What Is An Arms-Length Transaction?

An arms-length transaction in real estate is when a home buyer and a seller agree on a deal and have neither a business nor a personal relationship. ...more

Buying Your First Home

October 27, 2023•3 min read

Branch: Canopy Mortgage - TLC Group - 13809 Research Blvd, Ste 500, Austin, TX 78750 | Office #512-598-9093 | NMLSConsumerAccess.org #: 1359687 | Equal Housing Lender -All loans subject to credit and property approval.

Consumers wishing to file a complaint against a banker or a residential mortgage loan originator should complete and send a complaint form to the Texas department of savings and mortgage lending, 2601 North Lamar, suite 201, Austin, Texas 78705. Complaint forms and instructions may be obtained from the department’s website at www.sml.texas.gov. A toll-free consumer hotline is available at 1-877-276-5550. The department maintains a recovery fund to make payments of certain actual out of pocket damages sustained by borrowers caused by acts of licensed residential mortgage loan originators. A written application for reimbursement from the recovery fund must be filed with and investigated by the department prior to the payment of a claim. For more information about the recovery fund, please consult the department’s website at www.sml.texas.gov. State Licenses page, Privacy Policy, and Terms of Use

Facebook

Instagram

LinkedIn

Youtube

TikTok